In the modern era of investing, demat accounts have become an integral part of the financial landscape. As the world shifts towards digital transactions, demat accounts have revolutionized the way we trade and invest. In this comprehensive guide, we will explore the importance of demat accounts, their purpose, benefits, and the step-by-step process of opening one. Whether you are a seasoned investor or new to the world of trading, this guide will provide you with all the information you need to navigate the process of opening a demat account with ease and confidence.

Investing in the modern era requires a demat account, a digital platform that enables investors to hold and manage their securities in an electronic format. A demat account eliminates the need for physical share certificates, providing convenience, safety, and accessibility to investors. By utilizing a demat account, investors can seamlessly trade and manage their investments with ease.

Demat accounts serve as a secure repository for holding various securities, such as stocks, bonds, mutual funds, and exchange-traded funds. They offer numerous benefits, including:

– Convenience: Investors can access and manage their investments in one centralized platform.

– Safety and Security: Demat accounts eliminate the risks associated with physical certificates, such as loss, theft, or damage.

– Easy Transfers: Transferring securities becomes hassle-free, as the ownership is electronically transferred.

– Tracking and Management: Investors can conveniently track their investments and receive updates on corporate actions.

– Corporate Benefits: Dividends, bonus shares, and other corporate benefits are directly credited to the demat account.

A demat account is an electronic account that holds an investor’s securities in digital form. It is provided by a depository, which serves as a centralized entity for holding and maintaining records of securities. By converting physical certificates into electronic form, demat accounts streamline the process of buying, selling, and transferring securities.

Opening a demat account offers several advantages for investors, including:

– Seamless Trading: A demat account enables easy and quick trading of securities through online platforms.

– Paperless Transactions: It eliminates the need for physical documents, reducing paperwork and administrative tasks.

– Safe and Secure: Securities held in a demat account are protected from risks such as loss, theft, or damage.

– Efficient Portfolio Management: Investors can monitor and manage their investments conveniently in one place.

– Accessibility: Demat accounts provide 24/7 access to investment portfolios and trading opportunities.

We need to follow below steps for a demat account opening:

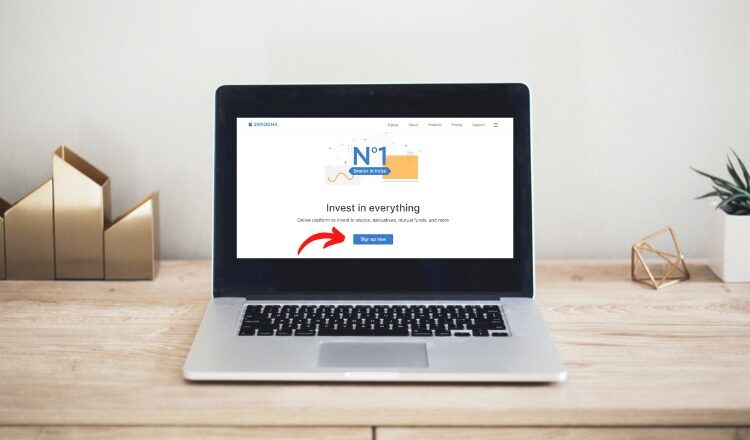

- Conduct Research and Select a Depository Participant (DP): Begin the demat account opening process by thoroughly researching and carefully selecting a reputable Depository Participant (DP) to entrust with your securities. Consider choosing a reliable DP, which can be a renowned bank or a well-established brokerage firm.

- Collect the Required Documents: Gather the necessary documents, including proof of identity, proof of address, PAN card, and passport-sized photographs.

- Fill Out the Account Opening Form: Provide accurate personal details, bank account information, and investment preferences.

- Submit the Application and Documents: Submit the completed application form along with the required documents to the chosen DP.

- Verification and In-person Verification (IPV): The DP will verify the documents and may require in-person verification, either physically or through video call.

- Sign the Agreement and Pay Charges: Read and sign the demat account agreement and pay the applicable charges, including account opening fees and annual maintenance charges (AMC).

- Receive Demat Account Details: Once the account is opened, you will receive the demat account number and other relevant details from the DP.

Documents Required for Opening a Demat Account

To open a demat account, you will need the following essential documents:

– Proof of Identity: PAN card, Aadhaar card, passport, or any other valid government-issued identity proof.

– Proof of Address: Utility bills, bank statements, driving license, or any other valid address proof.

– Passport-size Photographs: Recent photographs to be affixed on the account opening form and other relevant documents.

– PAN Card: A copy of your PAN card is mandatory for KYC compliance and tax purposes.

– KYC (Know Your Customer) Form: This form collects additional personal information, such as occupation, income details, and investment preferences.

Step-by-Step Guide to Opening a Demat Account

Detailed step-by-step instructions for opening a demat account:

– Research and select a reliable DP wisely

– Collect the required documents

– Fill the account opening form correctly

– Submit the application and documents to the chosen DP

– Undergo document verification and in-person verification (if required)

– Sign the demat account agreement and pay the necessary charges

– Receive the demat account details and confirmation

In conclusion, demat accounts have become an indispensable tool for modern investors. They offer convenience, safety, and accessibility, transforming the way we trade and manage investments. By understanding the account opening process and preparing the required documents, investors can open a demat account with ease and confidence. Utilize this complete guide as a valuable resource to streamline your demat account opening journey. Remember, a demat account combined with a reliable trading app empowers you to navigate the world of investing with convenience and efficiency. Embrace the digital revolution and embark on your investment journey with a demat account today!